Posted on 12 Jun 2018

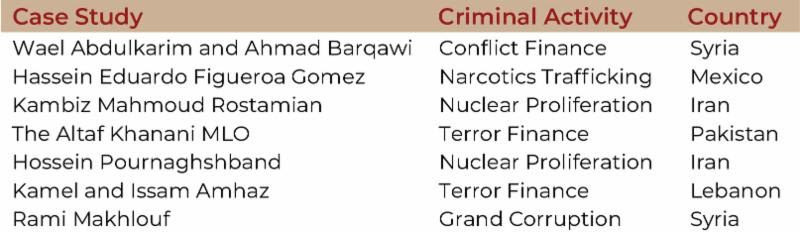

In this report, the authors examine seven individuals and organizations, their associated corporate networks, and their real estate holdings. They identify 44 properties worth approximately $28.2 million directly associated with sanctioned individuals, as well as 37 properties worth approximately $78.8 million within their expanded networks. Each of these people has been sanctioned by the United States (US), and many have also been designated by the European Union (EU) and EU members states. These networks are, therefore, deserving of particularly intense regulatory scrutiny. However, the research reveals that they have invested million of dollars in luxury UAE real estate while continuing to engage in illicit activity with the last few years.

Illicit actors, whether narcotics traffickers, nuclear proliferators, conflict financiers, kleptocrats, large-scale money launderers, or terrorists, all share a common need: they must move the proceeds of their criminal endeavors from the illicit marketplace into the licit financial system in order to use them effectively. Luxury real estate has emerged as a significant pathway for this conversion. Dubai, the largest city in the United Arab Emirates (UAE), has become a favorable destination for these funds due in part to its high-end luxury real estate market and lax regulatory environment prizing secrecy and anonymity. In this report, the authors examine the use of Dubai’s property market as a vehicle for sanctions evasion and other illicit activities.

The report examines seven individuals and organizations, their associated corporate networks, and their real estate holdings.

In nearly every case, the research finds:

- Properties associated with these individuals are directly connected to information within their sanctions designations. We identify a total of 44 properties associated with the primary sanctioned subjects across the seven profiles, of which 42 were previously unidentified.

- Expansive unsanctioned corporate networks, often with direct ties to the individual’s Dubai properties. These networks extend to jurisdictions as wide ranging as Syria, Romania, Mexico, Cyprus, Lebanon, Hong Kong, the United States, Liberia, and the British Virgin Islands, to name but a few.

- Extensive use of family and third-party networks like lawyers, business partners, and nominees to obscure beneficial ownership of both sanctioned and unsanctioned commercial entities.

- Ongoing activities for which the individuals and networks were originally sanctioned, activities that are, in some cases, more prolific than they were prior to the sanctions.

Click here for the interactive presentation