Posted on 12 Jun 2020

The coronavirus pandemic is affecting every aspect of global society – including organized crime. One effect of the pandemic with ramifications for organized crime is the reduced demand for oil.

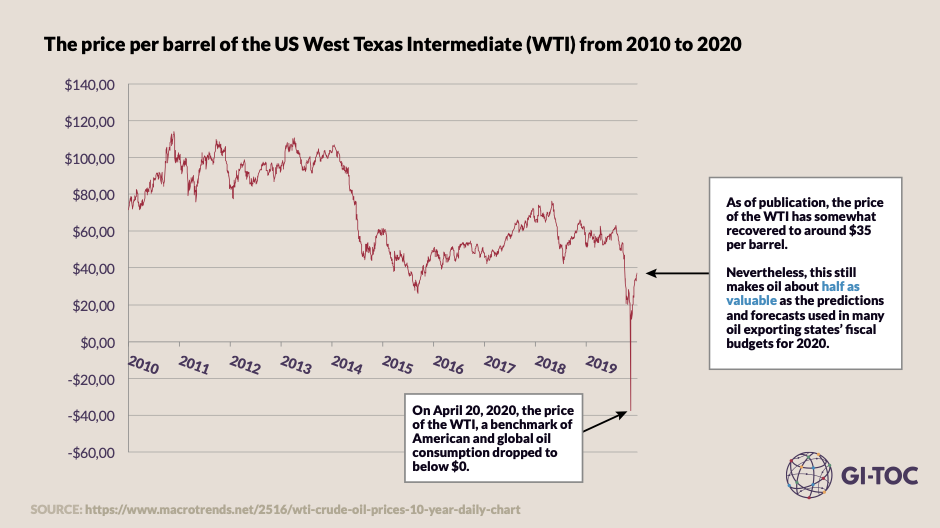

On 20 April 2020, the global price of oil dropped dramatically. In the United States, the prices of some oil futures dropped to negative values. Though these are an aberration caused by the way oil is traded, and the price has since recovered somewhat, many analysts believe that prices will never recover completely or will only recover slowly.

Cheap oil may be here to stay, and this is likely to affect organized crime in several ways.

The resource curse

Oil rents tend to dominate the economies of oil-exporting countries to the detriment of economic diversity and price stability. All too often, the result is poor governance and entrenched crime. Many oil-exporting countries are already hotspots of organized crime.

In Nigeria, for example, criminal interests exist at all levels, from politicians and military officers to oil company staff, militants and community members. The effect is that the country is more emblematic of the resource curse than of resource-led development. Nigeria ranks, for instance, 146th out of 180 on Transparency International’s Corruption Perceptions Index. The cost of this criminal impunity is immense. It has been estimated that US$42 billion worth of oil was stolen between 2009 and 2018 in Nigeria. The resource curse is not unique to Nigeria: most of the biggest oil exporters perform poorly on measures of organized crime and corruption. The recent oil price shock is likely to disrupt criminal economies the world over.

Shifting criminal incentives

The price shock will also change the incentives and rents of oil-related criminal economies – and as a result, actors in these economies may behave differently.

The price drop, and the resulting drop in profits, could reduce the incentive for criminal groups to engage with the oil industry. In the past, a number of criminal and insurgent groups involved in the oil industry have suffered when oil prices drop. For instance, the 2014 oil price crash reduced Daesh’s budget substantially.

But will the price drop bring about a more peaceful era? Not necessarily – it may just motivate organized-crime groups to seek other illicit income sources. In Mexico, which has the highest oil theft rate after Nigeria, the Sinaloa cartel and the Zetas have been increasingly connected to fuel theft in recent years. For the Mexican cartels, which reportedly turned to oil as a low-risk alternative to drug trafficking, it may renew their interest in drugs. Thus, decreased oil rents may lower criminal involvement in the oil industry without reducing organized crime. If states want to prevent organized-crime groups from turning to other, more predatory sources of income, such as extortion and trafficking, then it is vital that they capitalize on the momentary loss of criminal income.

The oil price crash may also change dynamics and power balances in armed conflicts, where criminal and insurgent groups often attack or take control of oil production. Libya, a major oil exporter, has been torn apart by a conflict that has been characterized as ‘all about controlling the rents’. Throughout the war, criminals and insurgents have seized control of oil concessions not only to fund themselves but also to undermine the state.

Ever since the war began in 2011, the country has been rocked by organized crime, trafficking in people, drugs and weapons – all of which prosper under conditions of heightened lawlessness. While the effect of the oil price drop on Libya’s civil war is not yet clear, there can be little doubt that it is ‘a new wrench thrown into the mix’, and there will be major organized-crime and trafficking implications for the Mediterranean and North African region.

Elsewhere, criminal interests seek to exploit the oil industry in more subtle ways. Alexandra Gillies makes a convincing prediction that corruption will decrease, but so will good governance. Corruption is expensive, Gillies argues, and becomes less attractive when the potential benefits are smaller. Evidence of this can be found among both corporate and governmental actors. When oil prices were high, companies were willing to take on greater risk. It is no coincidence that the so-called Petrobras Operation Car Wash scandal and the controversial deal for Nigeria’s OPL 245 oilfield took place when oil prices were rising, between 2008 and 2014. Under current conditions, with oil storage facilities overflowing and tankers unable offload their cargo, there is little motivation to risk criminal prosecution to acquire another concession. We can hope that cheap oil will improve corporate responsibility in an industry well known for the opposite.

While the price drop may discourage some oil-related criminal activities, it may encourage others. In markets of high volatility and novel demands, new opportunities arise. In licit and illicit markets alike, profits depend on where and when a commodity is traded. For some, the potential to profit by moving or storing oil in a way that takes advantage of price variations may be an incentive to cut corners. The pressure to react quickly during a crisis can create a powerful impetus for companies to take shortcuts and for governments, desperate for royalties, to turn a blind eye.

More poverty, tighter state budgets

Finally, the oil price crash will reduce rents not only for criminal interests but also for states and licit economies. New opportunities for organized crime will arise as a result of the economic downturn. As Fatima Denton asks, does the oil price drop mark a movement ‘from health crisis to development crisis’? The economic consequences will be drastic. Will African oil-exporting countries be able to maintain food imports in the face of dramatic currency depreciations? Food shortages, along with increasing unemployment and other forms of income loss, drive greater participation in informal economies and, in some cases, make people more vulnerable to exploitation by organized crime.

Libya exemplifies the risk of funding social security with oil rents. The Libyan government provides some of the most generous fuel subsidies in the world. Even if a large proportion (40 per cent by one account) of the subsidies are siphoned off illegally, they are still an important economic stabilizer for Libyans. In 2015, the World Bank found that cutting food subsidies in the country, which are also paid for with oil revenues, would double the poverty rate and decrease household spending by 10 per cent. Civil conflict aside, the dependence on oil rents to fund social services makes an oil-exporting country’s population even more vulnerable to economic collapse. With the little stability that is left in Libya heavily dependent on oil revenues, the oil price drop will destabilize the country even more, creating more opportunities for criminal networks.

There are certainly some reasons to be optimistic: low oil prices reduce the amount of money circulating in an industry tainted by corruption and violence. However, there are also substantial reasons for concern. A sharp decrease in funds could cause highly exposed actors to behave desperately. This may increase volatility by driving further corner-cutting as well as efforts to cultivate new illicit revenue flows. Many major oil exporters are already highly vulnerable to crime and corruption. In addition to their direct impact on organized crime, low oil prices increase the threat of economic downturn, in the form of shortages of goods and services, and loss of income. This may well create conditions in which organized crime will flourish. With no clear end in sight for cheap oil, it is crucial that states, companies, law-enforcement agencies and civil society are alert to the risks and challenges that may already be heading their way.